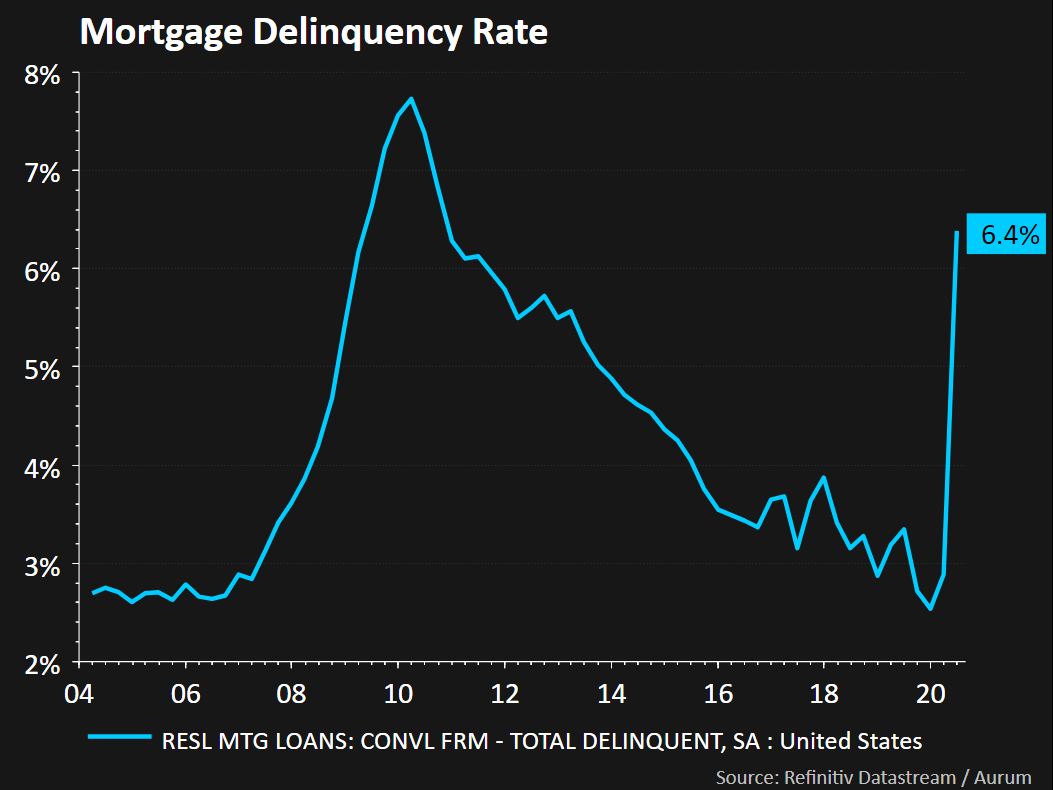

Amid a global pandemic and recession, the largest asset for most households continues to do well. Housing is on fire with bidding wars all over. This is in the face of lending standards tightening at banks and mortgage delinquencies climbing.

Though below the peak of the housing bubble, sales of new single-family homes hit a decade high this quarter.

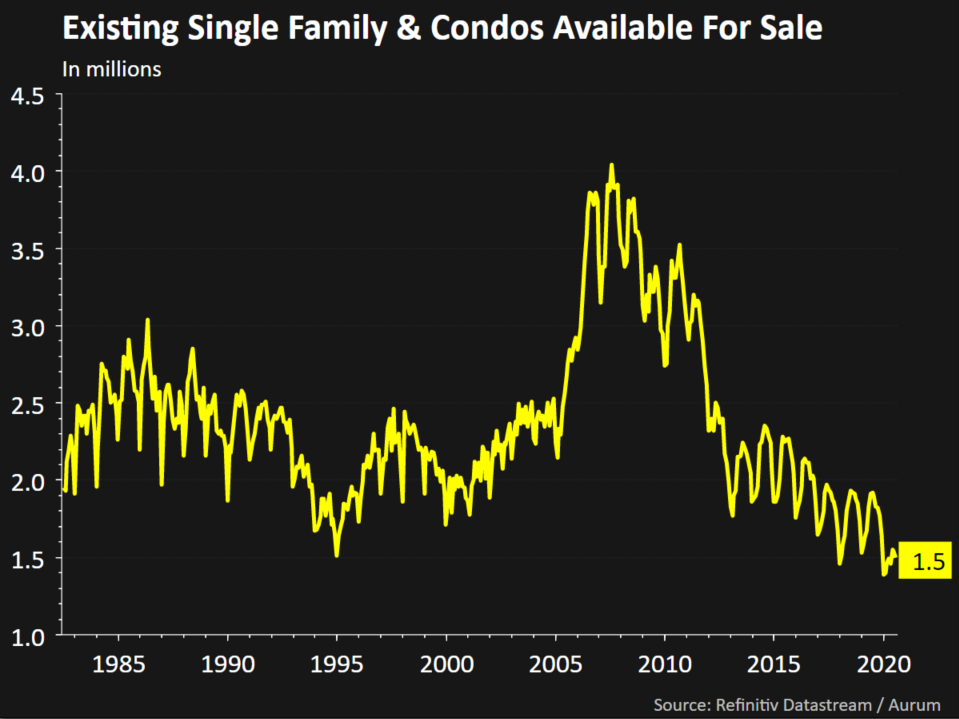

Contributing to the bidding wars is a simple case of supply and demand. There is a lack of homes available for sale. In July, there were 1.5 million homes for sale. This is the lowest figure for the summer months in the last 38 years.

On the demand side, millennials, a larger demographic than the baby boomers, enter their peak home purchasing years. Structurally, demand is increasing. As we learn in economics, if supply is down and demand is up, prices must move higher to find the equilibrium.

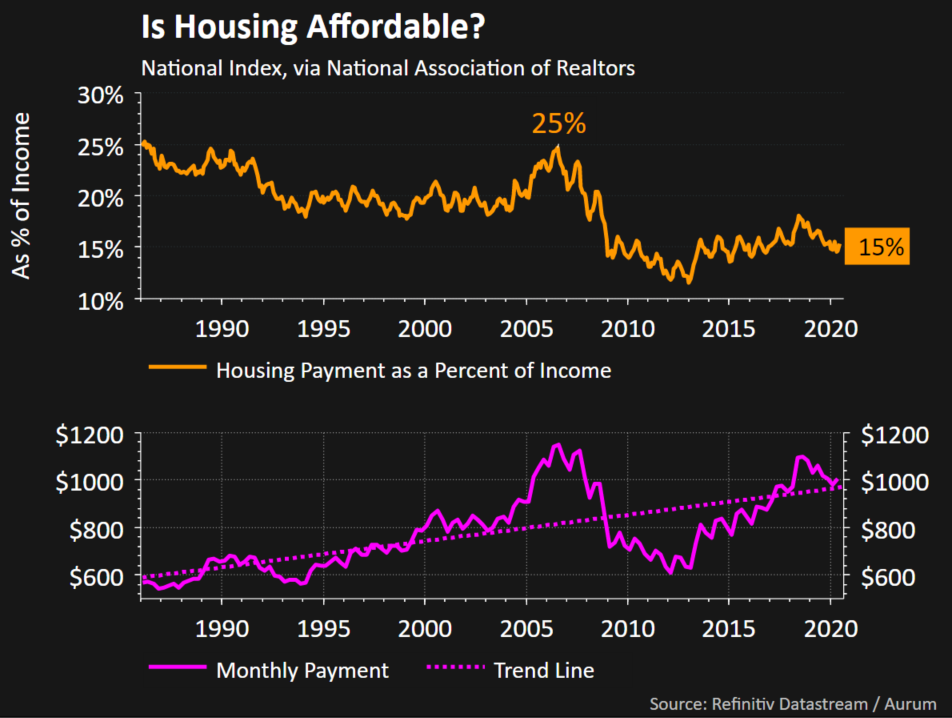

People base a housing purchase on the payment they can afford, not just the overall home price. Back in 2006, the average housing payment as a percent of income was 25% (below in the orange line). Even with home prices past the peak of the housing bubble, the average payment today is down to 15%. The dollar amount for monthly payments is in line with the trend from the past 35 years (below in the magenta line).

So where does that leave the housing market compared to the real estate bubble in the 2000s?

Mortgage lending in the past decade never reached the peak of the real estate bubble. Mortgage debt overall is at about the same level as 2007. Since then, home equity increased dramatically as home prices went up. This provides a huge buffer for mortgage bonds and homeowners even if prices soften.

Currently, forbearance from lenders are buying homeowners time to avoid the last crisis. The policy decisions, including record low mortgage rates, would need to shift for supply to rise.

This recession is not officially over. Yet the conditions from the housing bubble in the last decade are much different than in 2020.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth's current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.