Market Update: Black Swans & Silver Linings

By Michael McKeown, CFA, CPA - Chief Investment Officer

The concept of a Black Swan was made most notable by Nassim Taleb. He cites the story that prior to 1697, everyone in the world believed swans were white. That is, until black swans were discovered in Australia. This was unexpected in scientific history and changed the zoology world.

A black swan event is a metaphor that describes an event that comes as a surprise, has a major effect, and is often inappropriately rationalized after the fact with the benefit of hindsight.

A pandemic that changes the daily life of most people in the world is foreign to us. While the similarities to outbreaks over the past two decades have been pointed out by many, none of these canceled schools, sporting events, and forced business closures for extended periods.

The equity markets had the fastest fall from its peak to a 30% loss in history. In three days of trading in the last week, the market’s circuit breakers halted trading due to intra-day moves.

The government authorities, at last, acknowledged the gravity of Coronavirus (COVID-19) on Friday. There now is a coordinated effort among federal, state, and local governments to slow infections.

The past three weeks have felt like a re-run of 2008 because of the velocity and magnitude of the moves in financial markets. The source in the great financial crisis was internal to the financial system (between real estate, banks, and households) with too much leverage and falling prices. This is different because it is a shock outside the system.

The difference matters because it should not be a moral hazard argument for stepping up and supporting households and businesses. The Federal government has the power to support the economy. Even deficit hawk Greg Mankiw, Harvard professor stated, “There are times to worry about the growing government debt. This is not one of them.” Experts estimate a package in the trillions of dollars is needed.

The Federal Reserve cut rates two weeks ago by 0.50% and on Sunday cut rates an additional 1%. This puts the Federal Funds rate back at 0% to 0.25%, known as Zero Interest Rate Policy (ZIRP). They also announced an additional $700 billion in quantitative easing. Essentially the goal is to provide liquidity to the financial system to keep the credit markets functioning.

The risk is high for the economy currently. No one knows how deep the drop off in demand will be. It is difficult to handicap how long businesses will remain closed and how long industries like travel will take to be at the same run rate. Data out of China has seen an incredibly sharp fall across manufacturing, retail sales, and production. Other countries will likely show the same.

The Silver Lining

The flow of news has been bad and the stories out of Italy, Seattle, and all over are gut-wrenching. Eventually, the narrative will become less bad. The conditioning of the negative news flow will change. This could be several weeks to months away as the rate of cases slows, but markets will eventually respond.

Viruses have been with us forever. It seems there is a higher concentration of outbreaks where temperatures are between 30-50 degrees. Warmer weather may help according to experts.

Gilead Sciences has an experimental drug that has shown antiviral activity and will be in the testing phase soon. Researchers around the world are testing the efficacy of other treatments.

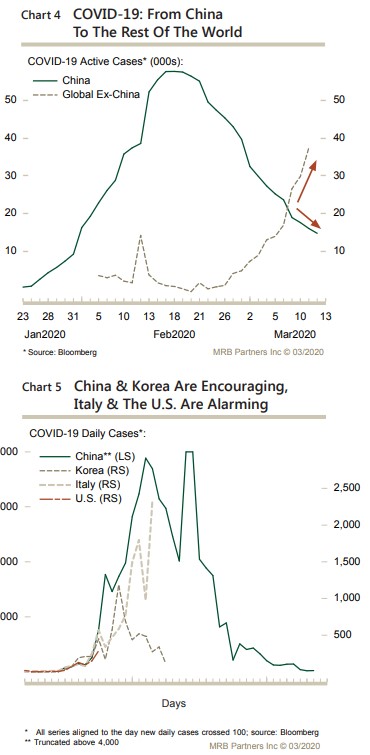

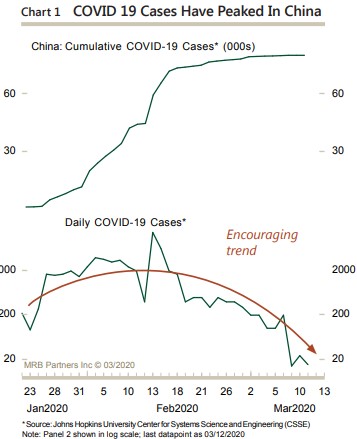

According to experts, social distancing worked in slowing the spread in places like China and South Korea. Upping the care available to patients with critical needs is the key. Given what we know about the speed in other countries, experts estimate the U.S. is behind some European countries by about two weeks.

Source: MRB Partners

Over the weekend, many retail stores announced closings across the country, including Apple. On the other side of the world on Friday, Apple reopened all 42 of its stores in China after being closed for about six weeks.

Stock prices in China are higher than they were at the lowest point at the beginning of February, which occurred about a week before cases began to slow in growth.

Source: MRB Partners

The markets need to see the healthcare policies implemented effectively, along with support from Congress and the President. Recessions are the nature of this economy and it is a very possible outcome in the next few quarters. The problem with investing is that once we are in a recession, stocks have already priced in this scenario.

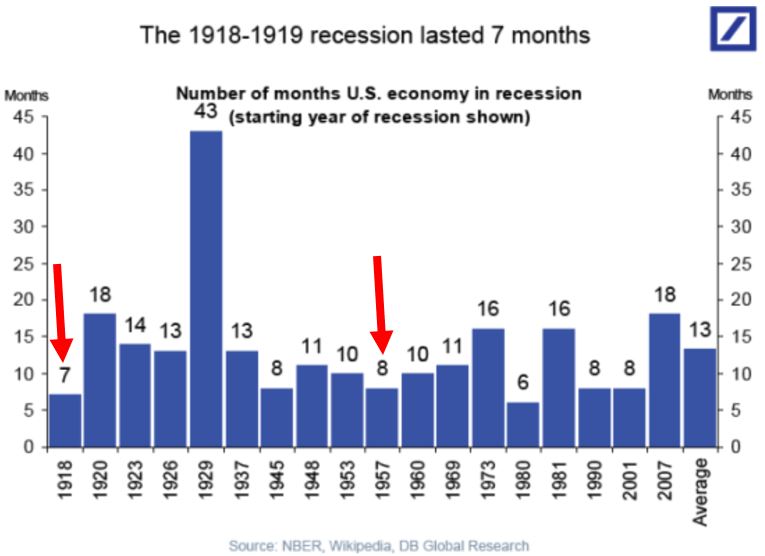

The recession of 1918 due to the Spanish flu lasted seven months. The recession coinciding with the pandemic of 1957 lasted 8 months. If history is a good guide, this could be a short-lived event.

Source: Deutsche Bank

We cannot control the markets, but we can control our process. We know Black Swans exist, but, they are not predictable (of course there will be people that called it, after the fact, known quite well in behavioral economics as hindsight bias). What is predictable is that markets move in a non-normal way, with price moves higher in magnitude and duration than what a normal bell curve would estimate as possible. We consider this in designing financial plans and investment portfolios. Scenario analysis for this is a must for stress testing portfolios, as we constantly do.

We continue to closely analyze the news, markets, and portfolios as this crisis unfolds. As markets fall, the expected returns on equities and credit investment increase. While being mindful of risk and the potential duration of this pandemic, we continue to search for opportunities.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum Wealth account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum Wealth accounts; and, (3) a description of each comparative benchmark/index is available upon request.