Last week we tried to put the coronavirus (COVID-19) pandemic in context. This week we talk markets and what investors should be thinking about.

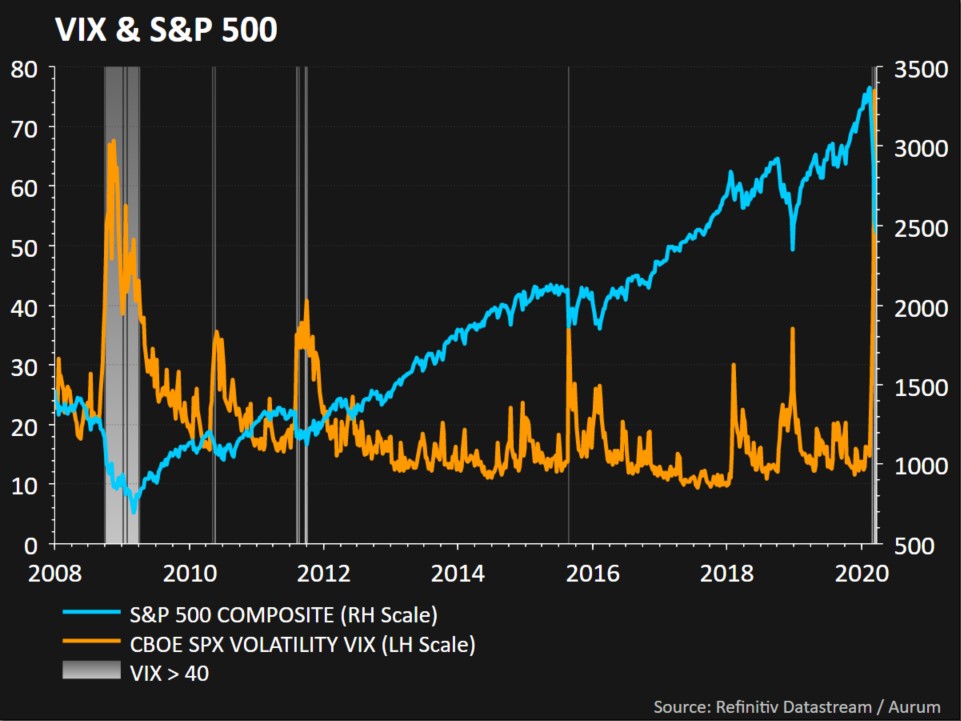

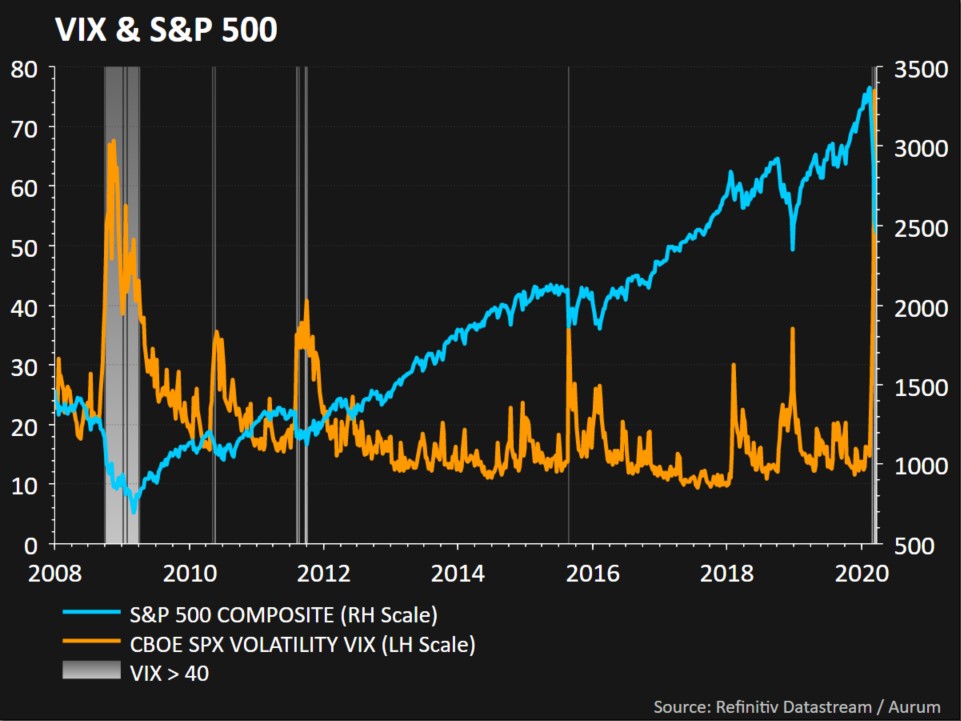

First, let's discuss how rare these types of market moves are. This is one of the fastest falls in prices ever. The day to day volatility moves in stocks are huge. The VIX represents the market's expectation of 30-day forward volatility. It is often quoted as the 'fear index.' In other words, when the VIX is high, the market perceives a wide range of outcomes. It reached a level of 80 in the great financial crisis in 2008 and just again this month.

Notice each of the periods over 40 (in grey vertical bars) coincided with what were long-term buying opportunities. These were all around troughs in prices for the S&P 500 Index.

Humans are not designed to see our resources go up and down in value on a computer screen. We are emotional beings and feeling scared is normal. But recognizing that everyone else is scared shows that this view is consensus. And being with the consensus is not always right.

In fact, a survey of investment advisors shows that more advisors are negative on the market than positive. We call this recency bias. The difference between bulls and bears in is in the 4th percentile. In other words, advisors were more positive on the stock market 96% of the time in the last 12 years than they are this week. The chart below shows bulls in blue (positive on the market), which have fallen to 30% this week. Bears are in orange (negative on the market), which has risen to 42%.

When we see unemployment rates expected to be so high and words like depression thrown around, can it get any worse? Is there a possibility that things become slightly less bad? Can the narrative change?

Over the previous weekend, my friends at Marcum LLP were putting together a presentation to help small business owners navigate this new world. They asked what I would tell investors to do. Below were my responses in bold, with an expansion of thoughts on each.

It is too late to de-risk portfolios, unless you are a leveraged investor or need cash.

Hopefully, you are never a forced seller. This means selling indiscriminately due to debt or panic. We want to be on the opposite side of this, buying assets by thorough analysis that someone is selling for uneconomic reasons. Last week, many hedge funds were forced out of positions due to leverage. This contributed to the volatility.

There are huge opportunities in the municipal bond market currently.

This one is moving fast due to the forced selling talked about above. Outflows from municipal funds were a record last week. In turn, this created value. The yield per year of duration reached the highest level in the past ten years. We noticed discounts on municipal ETFs and capital is being called from a long-time manager.

Corporate Credit markets are in the cheapest 5% of history.

This should be an area to consider adding. Cheap prices can always get cheaper, so buyer beware. We are just entering the downgrade cycle by credit agencies. Investors are beginning to price in these defaults.

Scaling into equity positions is the prudent approach. No one ever catches the bottom, not even professional investors.

Timing markets is hard. The cliché is said for a reason. In the moment, you never know if prices will go lower or higher. A value investor at least has a good sense if they are paying 60, 70, or 80 cents for something that should be worth a dollar. It requires patience and the willingness to be wrong in the short-term, for long-term gains. Framing lower prices as the ability to earn higher future returns is a better way to think.

If you have a view that this is a depression, then all bets are off on pricing.

The news and economic data are bad. It will likely persist for some time and we should prepare ourselves for the volatility. But we know what Yogi Berra said, "It's tough to make predictions, especially about the future."

If you didn't have perfect foresight previously for the direction of markets or this pandemic, what gives it to you now? I certainly do not claim to have it, however, it is unnecessary and usually unrepeatable anyways.

A policy error both on the healthcare front and fiscal stimulus plan are the biggest risk factors.

There is currently a wide range of outcomes, however, there are securities that are pricing in very draconian scenarios. This is a tough balancing act for policymakers, and we must acknowledge it. Even after passing the fiscal bill, implementation is important.There are reasons to be more positive when looking at the data, possible drug treatments, latitude levels of infection, etc.

But we typically read and follow what agrees with our priors, it is how we are built. Betting against human ingenuity has been a loser for a long time. Focus on your process, filter out the noise. If you need a process, reach out to us.There are many other aspects of the financial planning process investors can currently focus on besides the market direction. Tax-loss harvesting to offset against future gains is important. Rebalancing back to the target equity weights based on your financial plan adds value over time. Think about converting your traditional IRA to Roth IRAs. These are all within our control and process.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth's current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum Wealth account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum Wealth accounts; and, (3) a description of each comparative benchmark/index is available upon request.