Does Impeachment Matter to Markets?

By Michael McKeown, CFA, CPA - Chief Investment Officer

Over the last few decades, investors translated political headlines into market forecasts. This was rarely a profitable knee-jerk reaction. Does it make sense to do the same with impeachment?

Most political strategists believe that the House will impeach President Trump and the Senate will not.

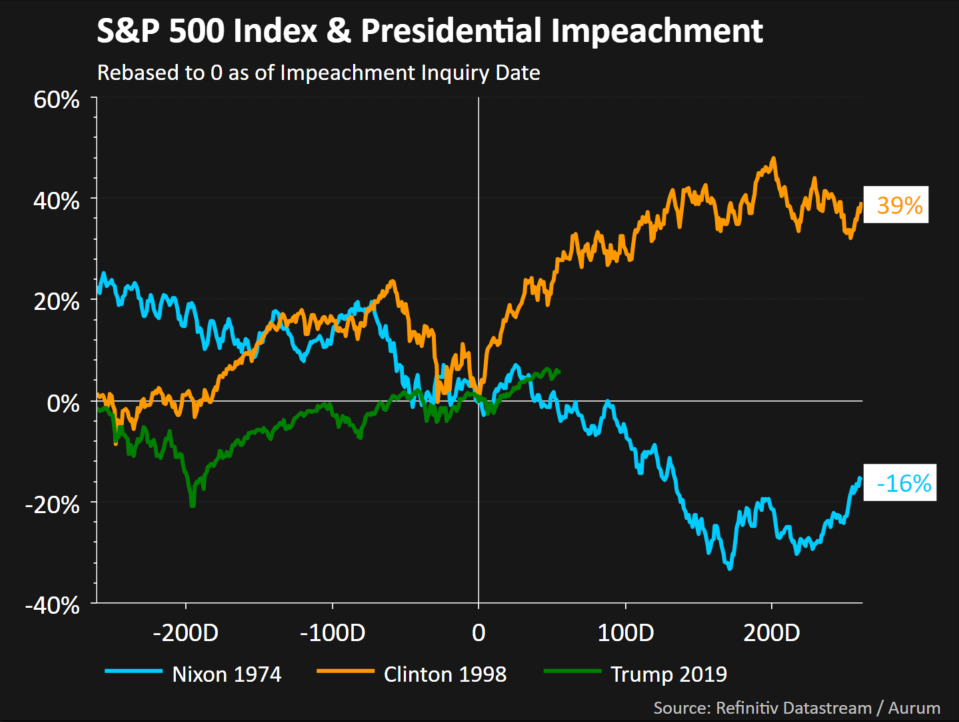

We thought it would be interesting to look back at how the market performed prior to and after past impeachment inquiries to see if any pattern emerged. Since there were only two prior instances in the last 50 years, the sample size is admittedly small.

The impeachment inquiry for President Nixon began on February 6, 1974. The date of October 8, 1998 was the beginning of the inquiry of President Clinton. In each case, the market fell 20% in the three months prior to the inquiry. However, the stock market drifted higher until September 24th of 2019, which was three months prior to the inquiry into President Trump.

In 1974, the stock market declined 50% from the peak to trough. A year after the inquiry began, it was down 16%. This was in the midst of war in the Mideast, oil prices quadrupling, and the annual inflation rate hitting 12%.

In the late summer of 1998, the stock market fell during the Asian currency crisis and failure of the gigantic hedge fund, Long-Term Capital Management. It took a bailout of the fund by both Wall Street and the Fed to stabilize markets in the fall of that year. Stocks would go on to rally nearly 40% over the next twelve months as the Tech Bubble reached its apex.

The market continues to drift higher in 2019 as the recession worries abated and the Fed lowered interest rates in the back half of the year. The labor market continues to improve while corporate profits have been steady. Surveys show that consumers and businesses are concerned about a slowdown in the economy, which already occurred outside of the U.S.

The fundamentals of the economy, corporations, and the consumer play a more important role in how the market moves than politics. With the two prior instances of impeachment resulting in wildly different market results, it is tough to draw a conclusion on the direction for today’s market. Our key takeaway is that mixing politics and market forecasts is a tough way to make money.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum Wealth account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum Wealth accounts; and, (3) a description of each comparative benchmark/index is available upon request.